Summary: The Triple Bottom Chart Pattern is a bullish reversal pattern formed after a downtrend. The pattern has three consecutive bottoms or lows nearly at the same level, which creates a unique support area. The breakout above the resistance line signals strong buying pressure and shift sentiments into a bullish trend. Traders enter a long position after the breakout of resistance.

In this blog post, we’ll learn about the triple bottom chart pattern, how to identify it, trading strategies, examples, and important tips to consider while trading with it. So, let’s discuss…

What is the Triple Bottom Chart Pattern?

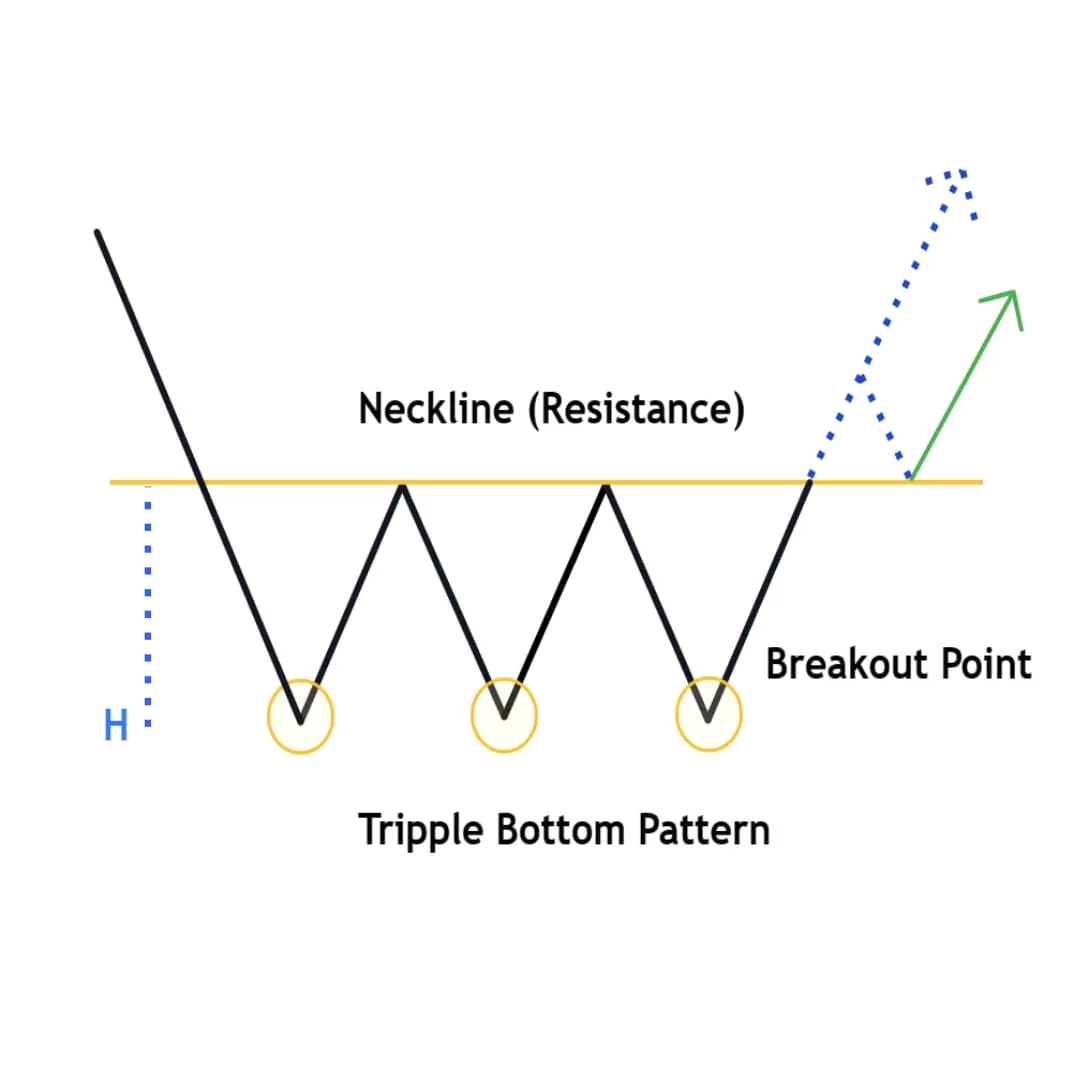

The Triple Bottom Pattern is a technical analysis chart pattern used to find a bullish reversal. It is characterized by three nearly equal lows followed by a strong breakout above the resistance/neckline formed by the peaks between the lows.

The pattern is complete once the price breaks above the neckline (resistance level), indicating a change in market sentiment from bearish to bullish.

This pattern usually forms over a longer period of time that means pattern likes to take its own sweet time to develop and shows a struggle between buyers and sellers before buyers finally gain control. Remember, this pattern tests your patience.

If you missed the double bottom pattern, there is no need to regret it, traders! Because the triple bottom pattern is here to save you, giving you a second chance to join the new trade.

How to Identify Triple Bottom Chart Pattern

To find the Triple Bottom Chart Pattern correctly, follow these steps:

- First, find three consecutive lows: the price reaches the support level three times without breaking below.

- Draw Neckline/Resistance Line: Draw a horizontal resistance line connecting the peaks.

- Breakout: This pattern is only confirmed after the price breaks above the neckline.

Formation of Triple Bottom Pattern

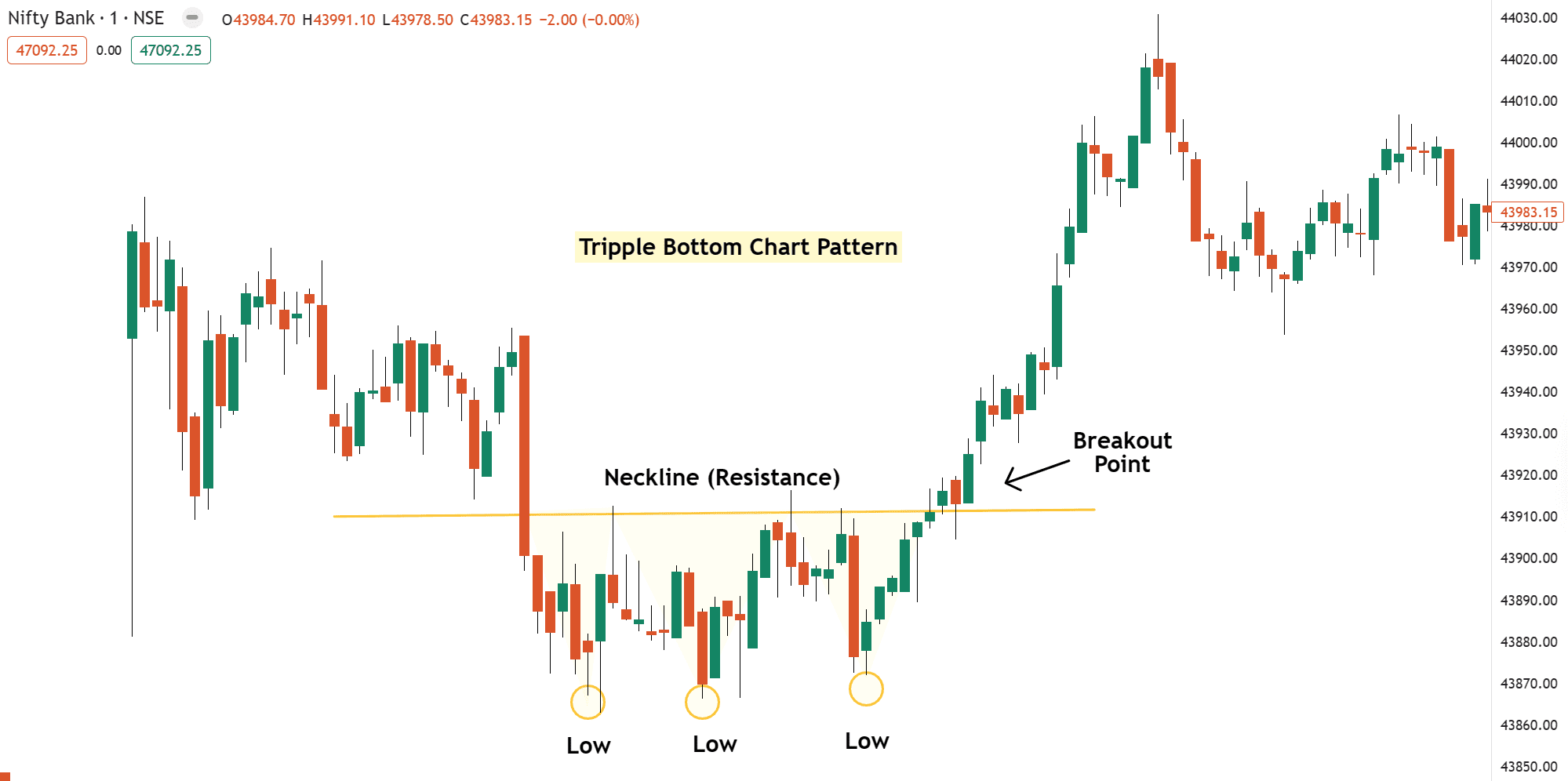

Example 1: Nifty Bank Triple Bottom Formation Analysis

A triple bottom is a bullish reversal chart pattern that is formed after a downtrend.

This pattern is formed with three lows below the resistance level

Three Lows (Acts as a Support)

First, identify the Triple Bottom formation, where the price reaches approximately the same level three times, consisting of the three distinct bottoms connected by a neckline.

Neckline (Acts as a Resistance)

Formed between the three lows and acts as a resistance line. Check the neckline correctly (Refer Above Example) and find three lows below the neckline or resistance line.

Breakout

Note, the formation of this pattern is completed when the price breaks the neckline after forming a third low, and the pattern is confirmed so traders can enter in bullish positions.

How to Trade Triple Bottom Pattern

There are certain rules when trading with Triple bottom chart patterns..

Once you’ve spotted this Triple Bottom masterpiece, prepare for the perfect trading entry!

Entery Point

When the price confidently breaks above the neckline, it is a sign that the triple bottom is about to reveal its full potential.

Traders enter a long position when the price breaks above the neckline or resistance level. This breakout offers a good opportunity to ride the wave of success!

Stop Loss

The stop loss should be placed below the third bottom of the pattern to manage risk.

If the price moves in your direction, trail your stop loss using this technical indicator (eg, 20 Moving Average) to protect your gains.

Profit Target

Measure the distance between the low and the neckline and Add this distance to the breakout point likely 1:1 to determine the profit target.

Pros & Cons of Triple Bottom Chart Pattern

Pros

- Strong bullish trend

- Provides perfect entry and exit points

- Effective in various timeframes

Cons

- Requires high patience for pattern completion because it takes too much time

- False breakouts

Common Mistakes to Avoid

When trading on triple bottom, avoid common mistakes like trading inside the range and relying too much on textbook patterns.

- Avoid early entry

- If data is confusing, don’t place a trade; wait for the next opportunity and protect capital first…

Have you traded double or Triple bottom patterns before? What is your favorite chart pattern aside from the Triple Bottom?

Let me know in the comments below!…..