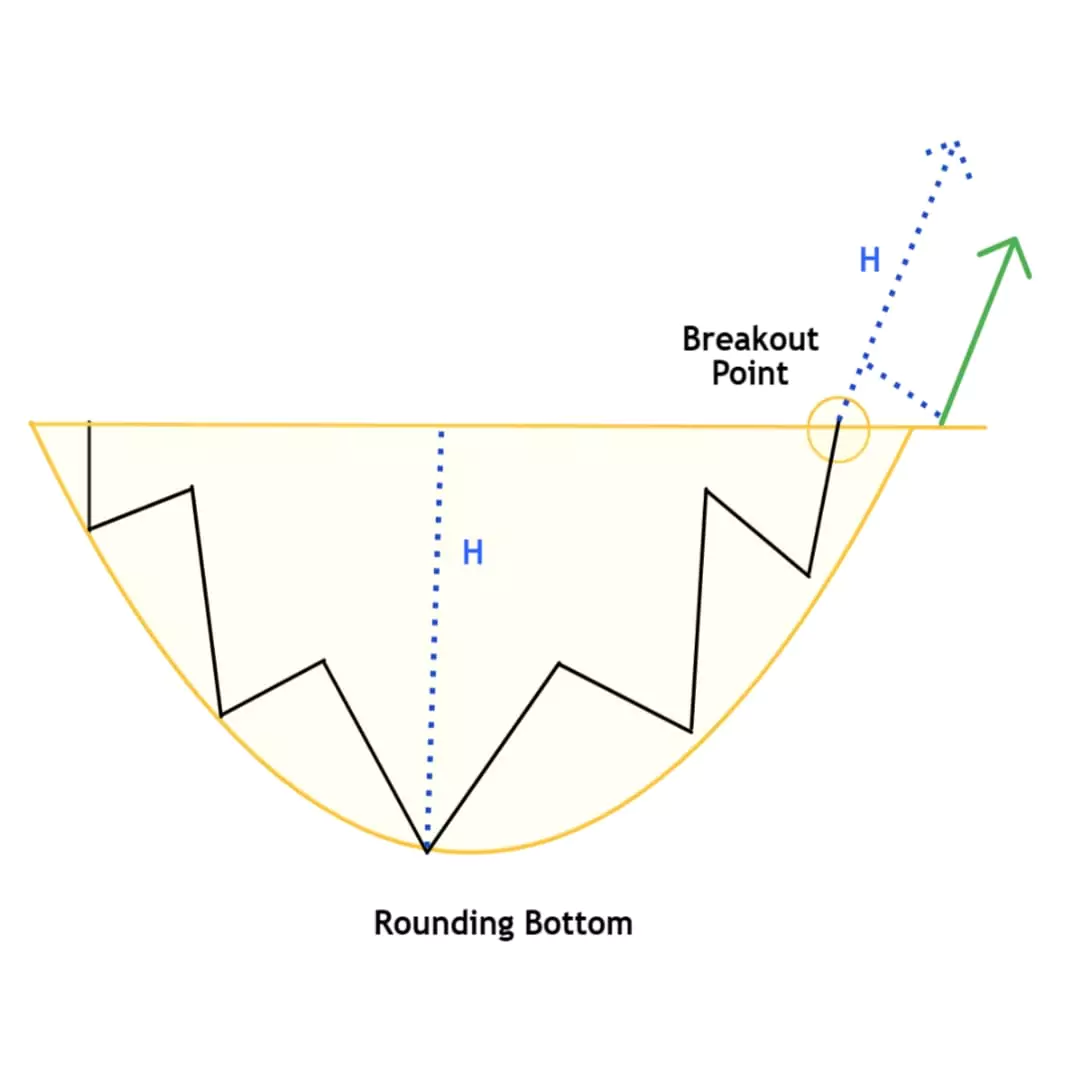

Summary: The Rounding Bottom Chart Pattern is a bullish reversal pattern that forms a smooth “U” shape sign that a falling market is slowly turning upward, This pattern shows that buyers are coming back, and prices may rise soon. Traders use it to spot long-term buying opportunities after a long downtrend.

In this blog post, we’ll learn about the rounding bottom chart pattern, how to identify it, trading strategies, examples, and important tips to consider while trading with it. So, let’s discuss…

What is the Rounding Bottom Chart Pattern?

The Rounding Bottom Pattern is also known as the Saucer Bottom that looks like a “U” shape, indicating a slow and steady reversal of a downward trend. Unlike sharp V-bottom reversals, this pattern forms over a longer period, showing a gradual transition in slightly sideways. It appears on daily or weekly charts and is followed by a breakout above the resistance level.

How to Identify the Rounding Bottom Chart Pattern

It’s straightforward. Just look “U” shape and follow these steps:

- Shape: Smooth and rounded “U” shape.

- Trend: Appears after a sustained downtrend.

- Price Action: Price decreases during the decline, then sideways during the base, and rises slowly.

- Resistance Level: The high point before the downtrend began acts as a breakout level.

- Breakout: A strong close above the resistance confirms the pattern.

Formation of a Rounding Bottom Chart

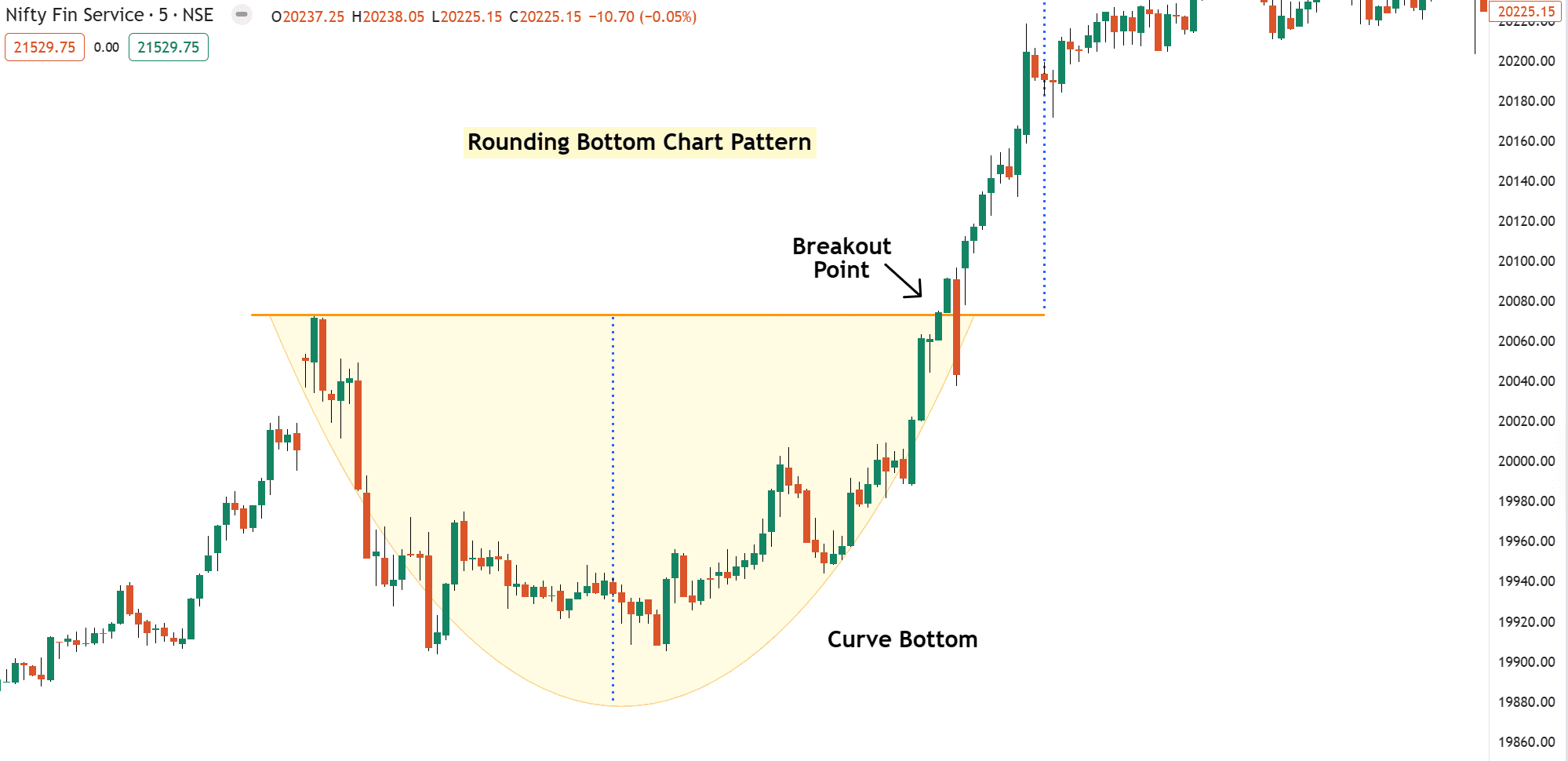

Example 1: Nifty Fin Service Formation Analysis

Downtrend Phase

First, The market is in a bearish phase, with falling price.

Bottom Phase (Sideways)

The price stops falling and moves sideways for some time. This shows that buyers are slowly coming in and the selling pressure is reducing.

Uptrend Phase

The price starts to rise slowly, forming the right side of the “U” shape.

Resistance

This is the previous high before the price started falling.

Once the price breaks above the resistance line, the pattern is confirmed.

How to Trade the Rounding Bottom Pattern

Once you’ve spotted this, there are certain rules to prepare for the perfect trading entry!

Entery

When the price confidently breaks and closes above the resistance, it is a sign that the pattern is about to reveal its full potential.

Traders enter a long position when the price breaks above the resistance level. This breakout offers a good opportunity to ride the wave of success!

Note: If you miss the breakout, don’t “chase” the markets now wait for a proper pull back.

Our Experience – Use this three powerful entry techniques: The breakout with buildup, The Re-test, The First Pullback.

Stop Loss

The stop-loss should be placed below the midpoint or the bottom of the pattern.

Note: If the price moves in your direction, trail your stop loss using this technical indicator (eg, 20 Moving Average) to protect your gains.

Exit

Measure the depth of the pattern and add this distance to the breakout point likely 1:1 to determine the profit target.

Pros & Cons of Rounding Bottom Pattern

Pros

- Strong bullish reversal signal

- Works well on longer timeframes.

Cons

- Time-consuming & requires patience

- Risk of false breakouts

Common Mistakes to Avoid

The duration of the pattern plays a key role, the longer it takes to form, the stronger and more significant to find the reversal signal. Shorter patterns are weaker and more likely to get false breakouts.

- Wrong timeframe: Best results are seen on higher timeframes like daily or weekly charts

- Entering before breakout: Always wait for a confirmed breakout above resistance.

Here’s what I’m curious about…..

Have you traded the rounding bottom or top patterns before? What is your favorite chart pattern aside from this?

Let me know in the comments below and share your thoughts!…..