Summary: The Rising Wedge Chart Pattern is a bearish trend reversal pattern that appears in an uptrend. It’s formed by two lines that slope upward, with the price making higher highs and higher lows. As the price moves inside the wedge, the upward movement slows down, suggesting a possible downward breakout when the pattern completes. Traders look for a breakdown below the lower trendline for confirmation of the reversal.

In this blog post, we’ll learn about the Rising Wedge Chart Pattern, how to identify it, trading strategies, examples, and essential tips to consider while trading with it. So, let’s discuss…

What is the Rising Wedge Chart Pattern?

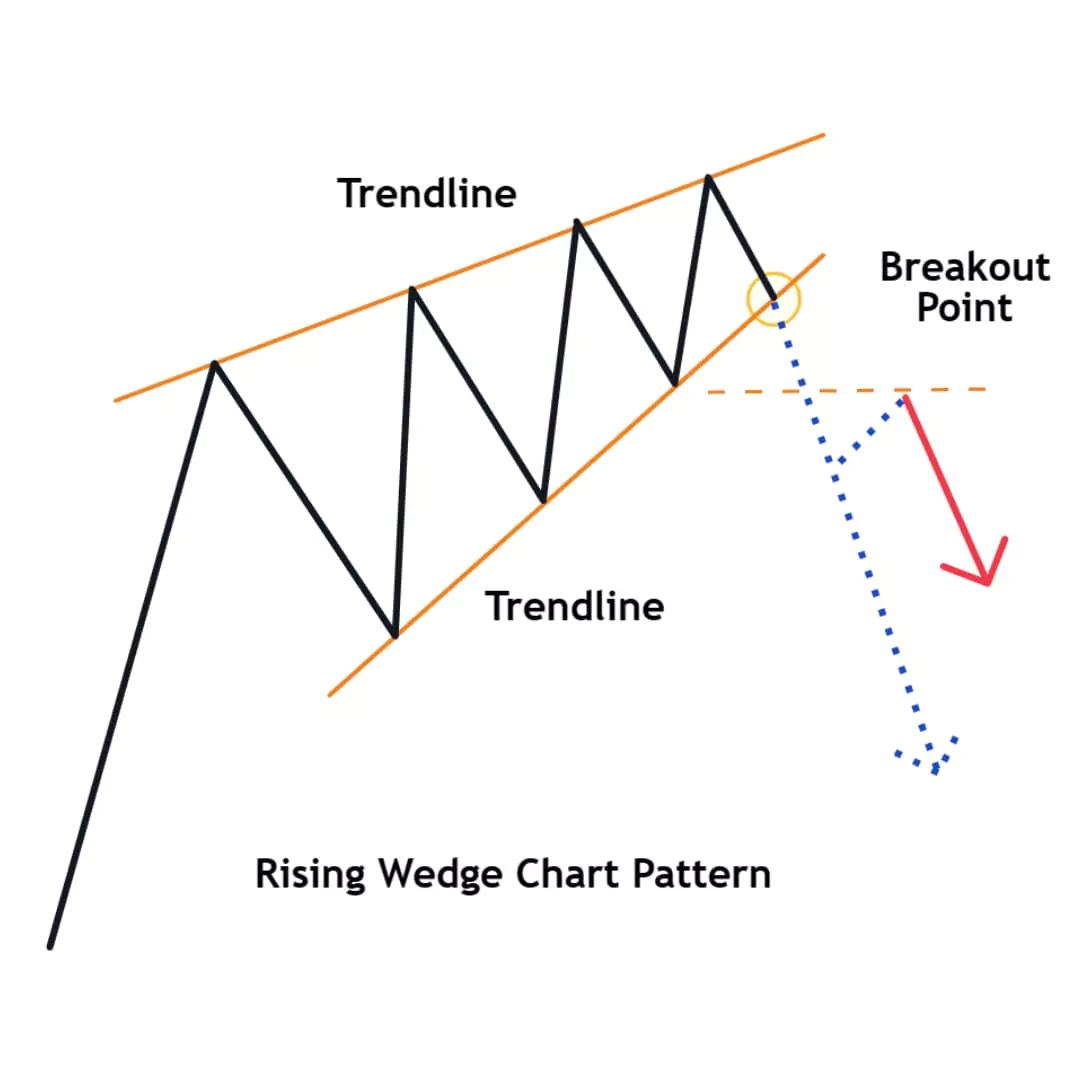

The Rising Wedge Pattern is a trend reversal chart pattern that usually forms after a long period of rising prices. It has two trendlines that slope upward, with the upper trendline acting as resistance and the lower trendline acting as support.

Inside the wedge, the price creates higher highs and higher lows, but the rise slows down over time, which signals that the price might soon reverse and start falling. This pattern is considered a bearish reversal, meaning it suggests the price could go down once the pattern is complete.

How to Identify

Follow these steps to identify the falling wedge perfectly:

- Look for a clear uptrend

- Draw two trendlines, one along the higher high (resistance) and the other along the higher lows (support).

- Make sure the price is moving within the wedge and the gap between the two lines gets smaller over time.

- The pattern is confirmed when the price breaks below the lower trendline support.

Formation of Rising Wedge Chart Pattern

Example 1: Nifty 50 Rising Wedge Formation Analysis

Uptrend

This is a first phase where the market is in an uptrend, and the price keeps making higher highs and lower highs. This means buyers are in control, and the price is rising strongly.

Wedge Formation or Consolidation

As the pattern forms, the speed of the rise starts to slow down. The price is still making higher highs and lower highs, but the moves are smaller range. (Refer above e.g.)

In this pattern, both the upper resistance and lower support trendlines slope upward, but the lower trendline rises at a steeper angle than the upper one. This causes the two lines to converge and create a wedge shape. This formation suggests that buyers are losing strength, and sellers may take control.

Breakout

The pattern is complete when the price breaks below the support line (the lower trendline). This breakout signals that the uptrend is over.

This pattern is the perfect example of price action, where higher highs and higher lows are getting narrow, showing the market going up step by step, but buyers lose their momentum. Now, that means buyers are weak, and a sudden bearish breakout shows the trend get reverse and price will fall.

How to Trade the Rising Wedge Pattern

There are some rules when trading with Rising Wedge

Once you’ve spotted this pattern, prepare for the perfect trading entry!

Entery Point

Enter the trade when the price breaks below lower trendline support and wait for a candle to close below the support to get confirmation.

Or you can wait for a Retest/Pullback to protect from falls breakout

Stop Loss

Place the stop loss above the high of the last low inside the wedge.

If the price moves in your direction, trail your stop loss using a technical indicator like moving average or ATR to protect your gains.

Profit Target

Measure the height of the wedge from the widest point (the initial price range), then add that same distance below the point where the breakout happens. This gives you a rough idea of where the price might go next.

Pros & Cons of Falling Wedge Chat Pattern

Pros

- This pattern helps to find trend reversal.

- Suitable for short-term trading

Cons

- False breakouts possible (Candle Wicks)

- A Rising Wedge is a bearish reversal pattern, but if the overall market sentiment remains strongly bullish, the pattern may fail.

Common Mistakes to Avoid

When trading with this pattern, avoid some common mistakes like trading inside the range and relying too much on textbook patterns.

- Don’t enter before the breakout confirmation.

- Misdrawing trendlines or forcing pattern

Most importantly, if the pattern looks confusing, it’s okay to skip the trade to protect your capital is more important.

Have you traded the Wedge pattern before? What is your favorite chart pattern aside from this one?

Let me know in the comments below!…..