Summary: The Inverted Pole and Flag Chart Pattern is a bearish continuation pattern that signals a brief pause before the price resumes its trend. It consists of a strong bearish move known as a pole, followed by a short consolidation known as a flag. Once the price breaks below the flag, it continues in the bearish direction. This pattern gives a clear entry, stop-loss, and target levels with strong risk-reward potential.

In this blog post, we’ll learn about the inverted pole and flag chart pattern, how to identify it, trading strategies, examples, and important tips to consider while trading with it. So, let’s discuss…

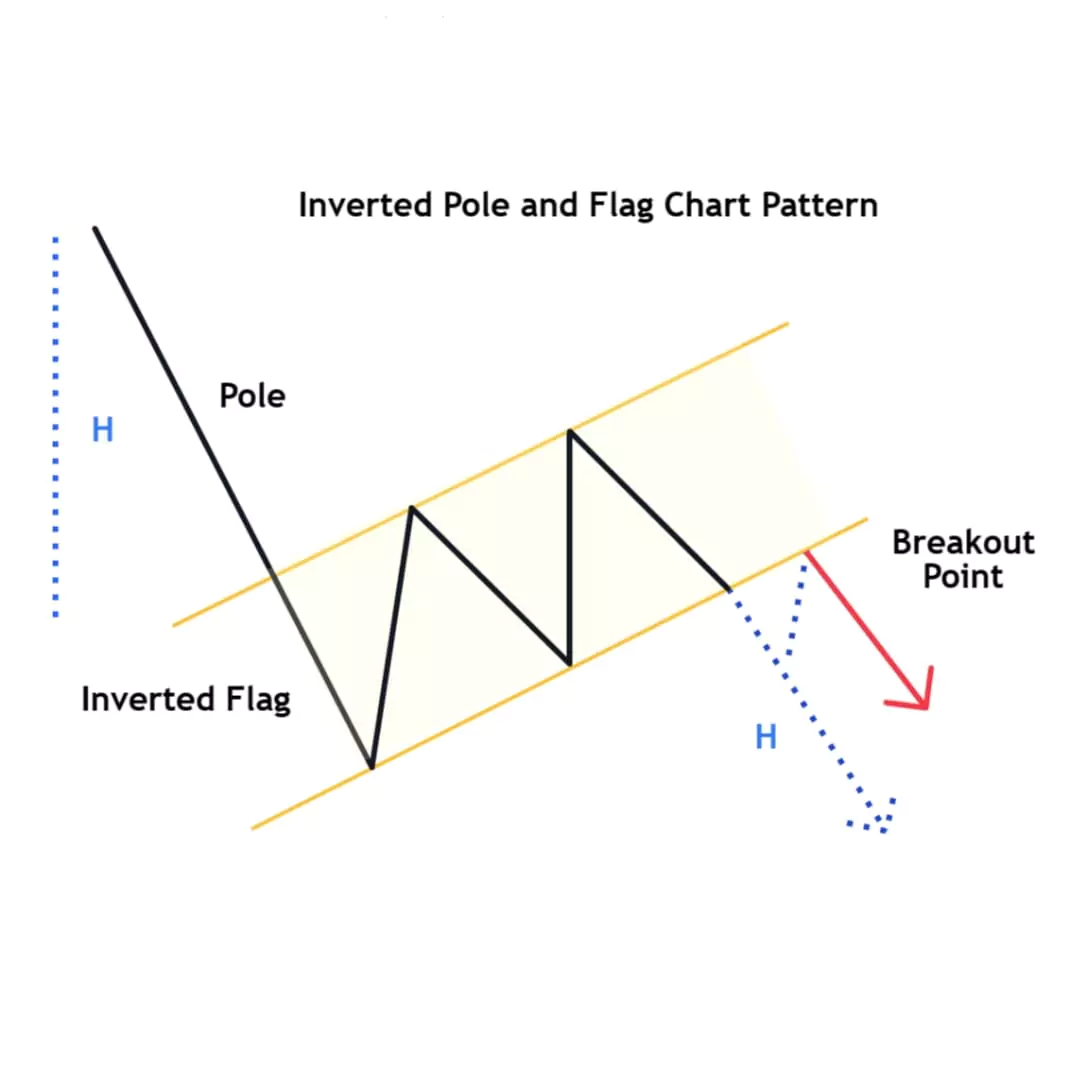

What is the Inverted Pole and Flag Chart Pattern?

The Inverted Pole and Flag Chart Pattern is a popular bearish continuation pattern used in technical analysis to identify a downtrend. It is opposite the pole and flag pattern.

The pattern looks like a price falling quickly followed by a short pause, just like a flag on a pole in the inverse direction. First, the price falls fastly, that is the pole. Then it takes a pause and moves sideways in slightly against the trend that’s the flag. After this short rest, the trend usually continues in the same direction.

It’s a popular pattern that helps traders spot good entry points during trend continuation.

How to Identify the Inverted Pole and Flag Chart Pattern

It’s simple! Just looks like a flag waving on a pole, and imagine it in inverse mode. Follow these steps:

- Pole – A sharp downward move, showing a strong bearish trend.

- Flag – Sideways in consolidation area. It should be smaller than the pole.

- The pattern is confirmed when the price breaks below the flag area, which is known as consolidation.

Formation of Inverted Pole and Flag Pattern

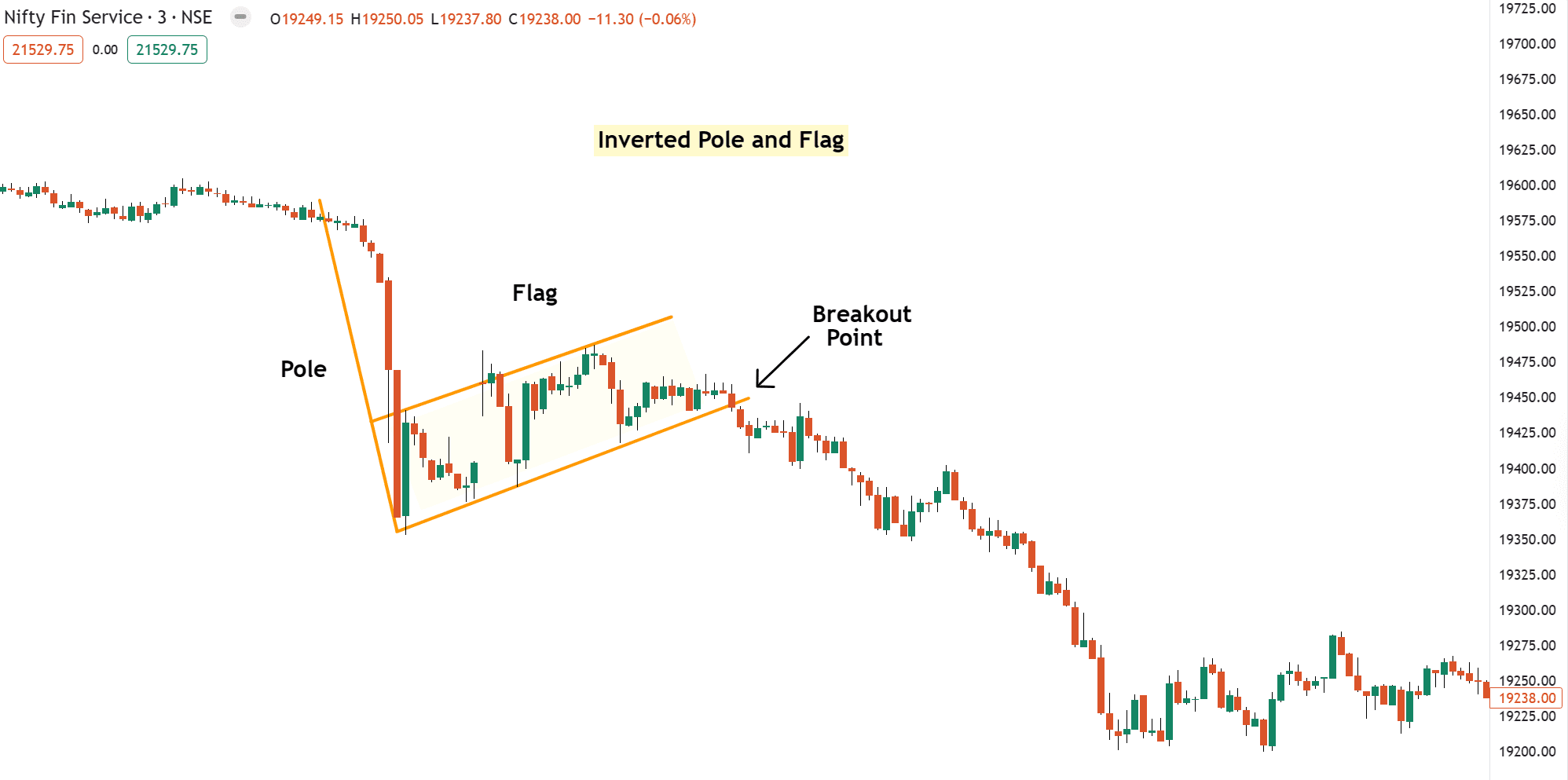

Example 1: Nifty Fin Service Inverted Pole & Flag Formation Analysis

Pole Formation

The pole is created when the price moves sharply in a downtrend, which is a short period of time that represents a strong bearish momentum.

This usually happens after a major news event or breakout from another chart pattern showing strong selling pressure.

Flag Formation

After a sudden fall, the price takes a short pause and moves sideways in slightly upward direction like a rising channel.

This creates the flag shape like a small rectangular upward channel.

Breakout

When the pause is over and price breaks below the upper trendline of the flag, we see a sharp and quick bearish breakout confirming the continuation of the trend.

How to Trade Inverted Pole and Flag Pattern

There are some rules when trading with Bearish pole and flag patterns..

Once you’ve spotted this inverted pole and flag masterpiece, prepare for the perfect trading entry!

Entery Point

Enter the trade when price breaks below the lower trendline of the flag and wait for a candle close below the flag for confirmation.

Stop Loss

Place the stop loss above the high of the flag to manage risk.

If the price moves in your direction, trail your stop loss using this technical indicator (eg, 20 Moving Average) to protect your gains.

Profit Target

First, measure the height of the pole, then add that same distance below the point where the breakout happens. This gives you a rough idea of where the price might go next.

Pros & Cons of Inverted Pole & Flag Pattern

Pros

- High probability setups in trending with technical patterns.

- Easy to find pattern

- Provides well-defined entry, stop-loss, and target levels.

- Best continution cattern for trade with trend

Cons

- Requires high patience when market is in consolidation (Sideways)

Common Mistakes to Avoid

When trading with this pattern, avoid some common mistakes like trading inside the range and relying too much on textbook patterns.

- Don’t trade inside the flag. Wait for a clean breakout.

Most importantly, if the pattern looks confusing, it’s okay to skip the trade to protect your capital is more important.

Have you traded the Pole and Flag or its inverted pattern before? What is your favorite chart pattern aside from the pole and flag?

Let me know in the comments below!…..