Summary: The Head and Shoulders Pattern is a bearish chart pattern that forms after an uptrend, indicating that sellers are gaining control. The pattern resembles a person’s head and shoulders, consisting of three peaks: a higher middle peak (head) between two lower peaks (shoulders). The pattern is confirmed when the price breaks below the neckline, signaling a potential downward movement.

In this blog post, we’ll learn about the head and shoulders chart pattern, how to identify it, trading strategies, examples, and important tips to consider while trading with it. So, let’s discuss…

What is the Head and Shoulders Chart Pattern?

The Head and Shoulders Chart Pattern is a popular bearish reversal pattern used in technical analysis to identify potential downtrend.

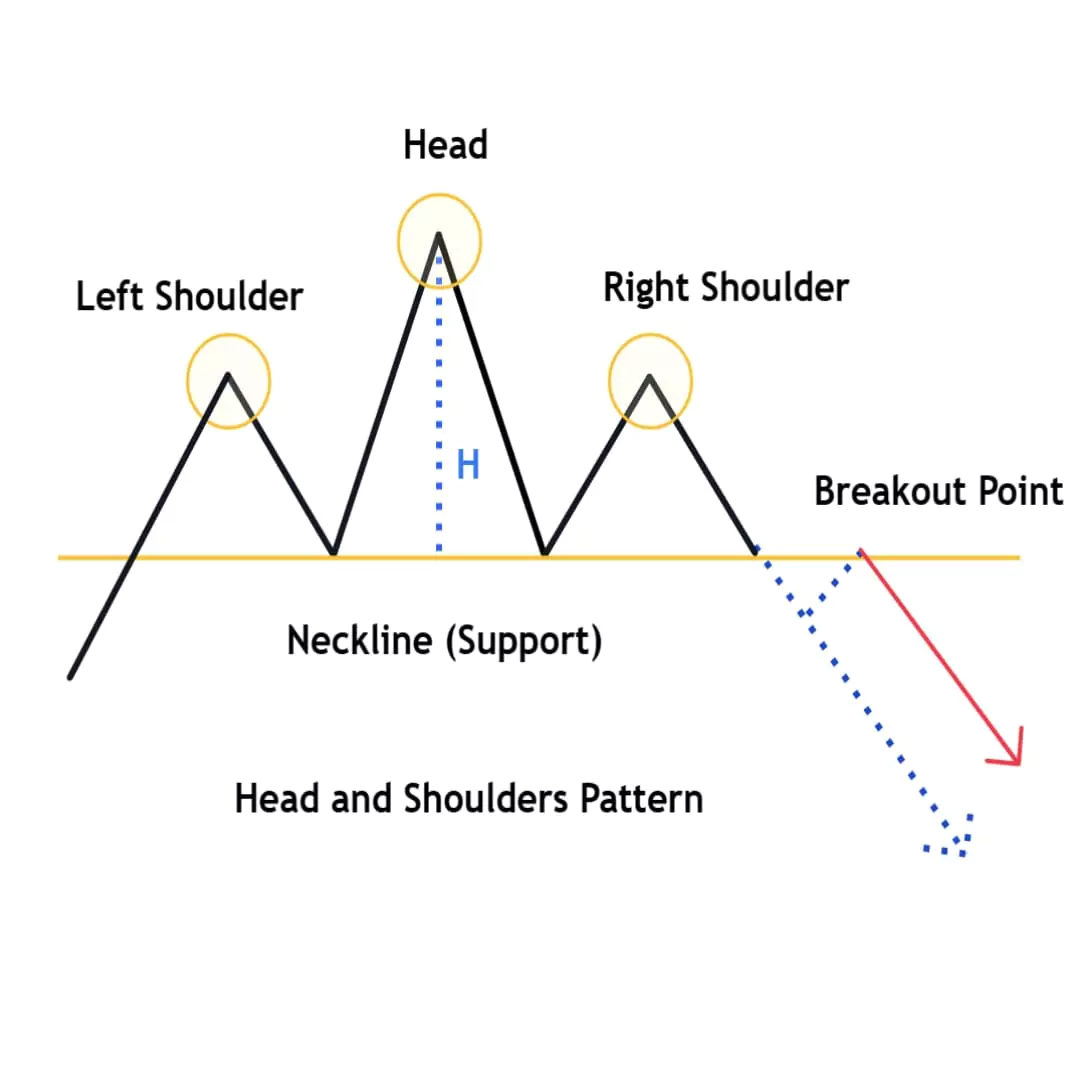

This pattern includes three peaks (highs): the highest peak in the center (known as the head) and two lower peaks on either side (known as the shoulders). Refer to the image above for visual reference.

The pattern is complete when the price breaks below the support or neckline. Indicates change in market sentiment from bullish to bearish.

How to Identify the Head and Shoulders Chart Pattern

It’s quite simple! Just look for the classic head and shoulders shape (similar to the shape of a person’s head and two shoulders) and follow these steps:

- Find the pattern after a significant uptrend.

- First, the price rises to a peak (high) and then pulls back, forming the first (left) shoulder. Now, the second time price rises again and breaks previous high and create a new higher peak, then prices declines this creates the head and last the price makes another attempt to rise but create a lower high (similar to the left shoulder) and then pulls back again.

- Draw a line connecting the lows between the shoulders. This is the neckline, acting as a support level. It can be horizontal or sloped. The neckline acts as a support level before the pattern completes.

- This pattern is only confirmed after the price breaks below the neckline.

Formation of Head and Shoulders Chart

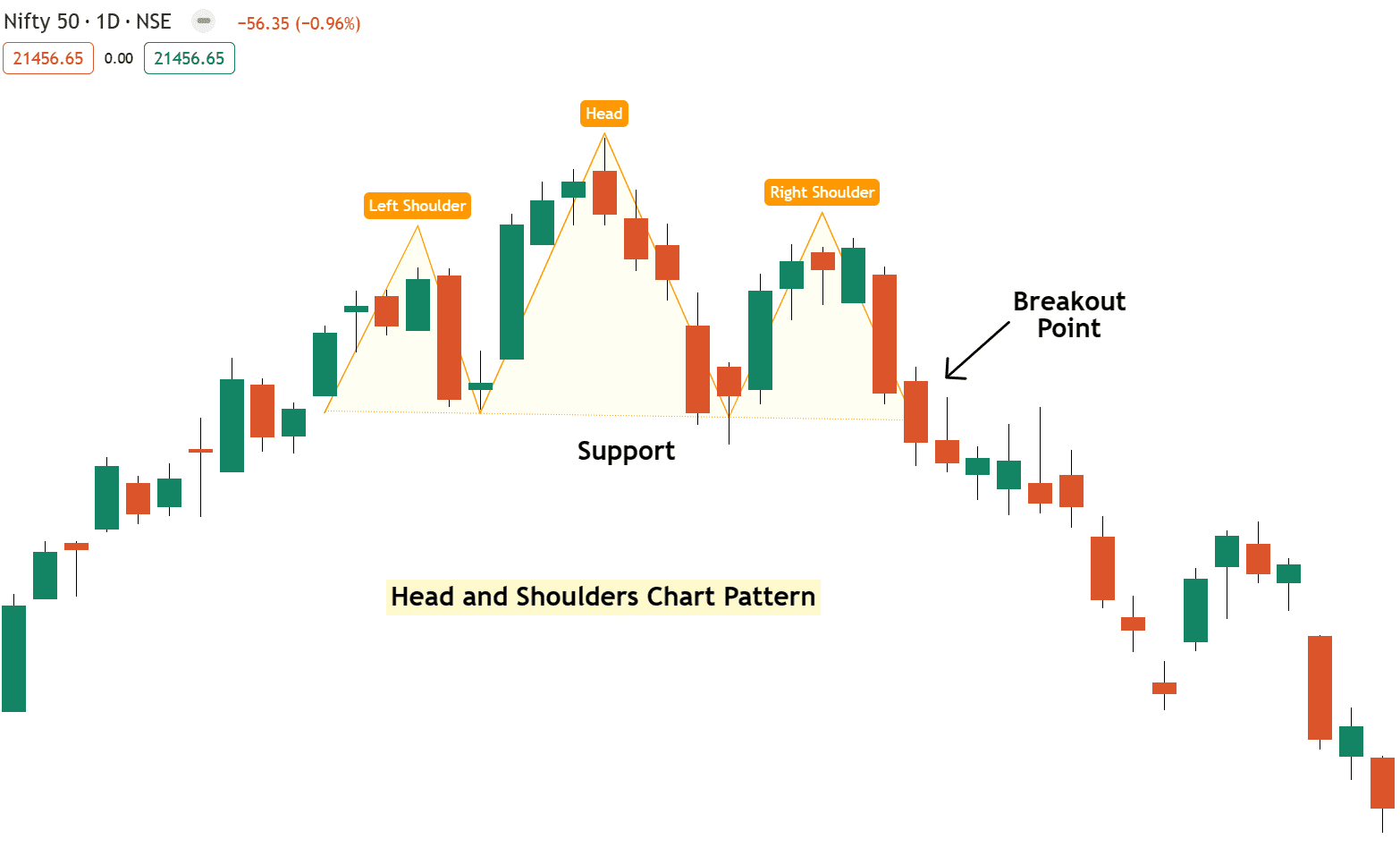

Example 1: Nifty 50 Formation Analysis

Left Shoulder

The first high forms after an upward move and represents a temporary high, known as the left shoulder (refer to the example above).

This is a short pullback against the uptrend because of profit booking or exits by traders.

Head

The price rises again and creates a higher peak than the left shoulder, this becomes the head, the highest point of the pattern.

This middle higher high formation shows that buyers are still in control they push the price higher but suddenly, sellers are also stepping aggressively and create the “stronger” pullback to re-test the previous low.

Right Shoulder

Now this is a lower low similar in height to the left shoulder that indicates weakness in uptrend momentum.

This high represents that buyers are getting weak as they couldn’t push the price higher. but sellers are strong as they continue to fall the price downward.

Neckline

A support line (either horizontal or sloping) is drawn across the two dips formed between the shoulders and the head.

If the price breaks below this neckline, the Head and Shoulders pattern is confirmed, indicating a potential bearish reversal and the start of a downward move.

How to Trade the Head and Shoulders Pattern

There are a few important rules to follow when trading with head and shoulders chart patterns.

Once you’ve spotted this head-and-shoulders masterpiece, prepare for the perfect trading entry!

Entery

When the price confidently breaks below the neckline, it is a sign that the pattern is about to reveal its full potential.

Traders enter a short position when the price breaks below the neckline or support level. This breakdown offers a good opportunity to ride the wave of success!

Note: If you miss the breakout, don’t “chase” the markets now, wait for a proper pullback.

Our Experience – Use these three powerful entry techniques: The breakout with buildup, The Re-test, The First Pullback.

Stop Loss

The stop loss should be placed below the right shoulder of the pattern to get a better risk reward ratio.

Note: If the price moves in your direction, trail your stop loss using this technical indicator (eg, 20 Moving Average) to protect your gains.

Exit

Measure the distance between the head to the neck and add this distance to the breakout point likely 1:1 to determine the profit target.

If your SL is below the right shoulder, you can consider approx. 1:2 risk reward ratio

Pros & Cons of Head and Shoulders Pattern

Pros

- Find strong Bearish trend

- Provides better risk reward with clear entry and exits.

- Works well with using multiple timeframes (Pro tip use bigger timeframe for more accuracy)

Cons

- Requires high patience

- Requires more confirmation for accuracy (learn Price Action)

Common Mistakes to Avoid

The duration of the head and shoulders pattern plays a key role, the longer it takes to form, the stronger and more significant to find the reversal signal. Shorter patterns are weaker and more likely to get false breakouts, especially against the trend.

Here’s what I’m curious about…..

Have you traded the Head and Shoulders patterns before? What is your favorite chart pattern aside from this?

Let me know in the comments below and share your thoughts!…..