Summary: The Falling Channel Chart Pattern is a bearish continuation pattern formed by two downward parallel trend lines acting as support and resistance. It indicates a strong downtrend with lower lows and lower highs formations. Traders look for breakdowns below support for bearish signals or breakouts above resistance for bullish reversal signals. Proper risk management and price action analysis are important to avoid false breakouts.

In this blog post, we’ll learn about the falling channel chart pattern, how to identify it, trading strategies, example, and important tips to consider while trading with it. So, let’s discuss…

What is the Falling Channel Chart Pattern?

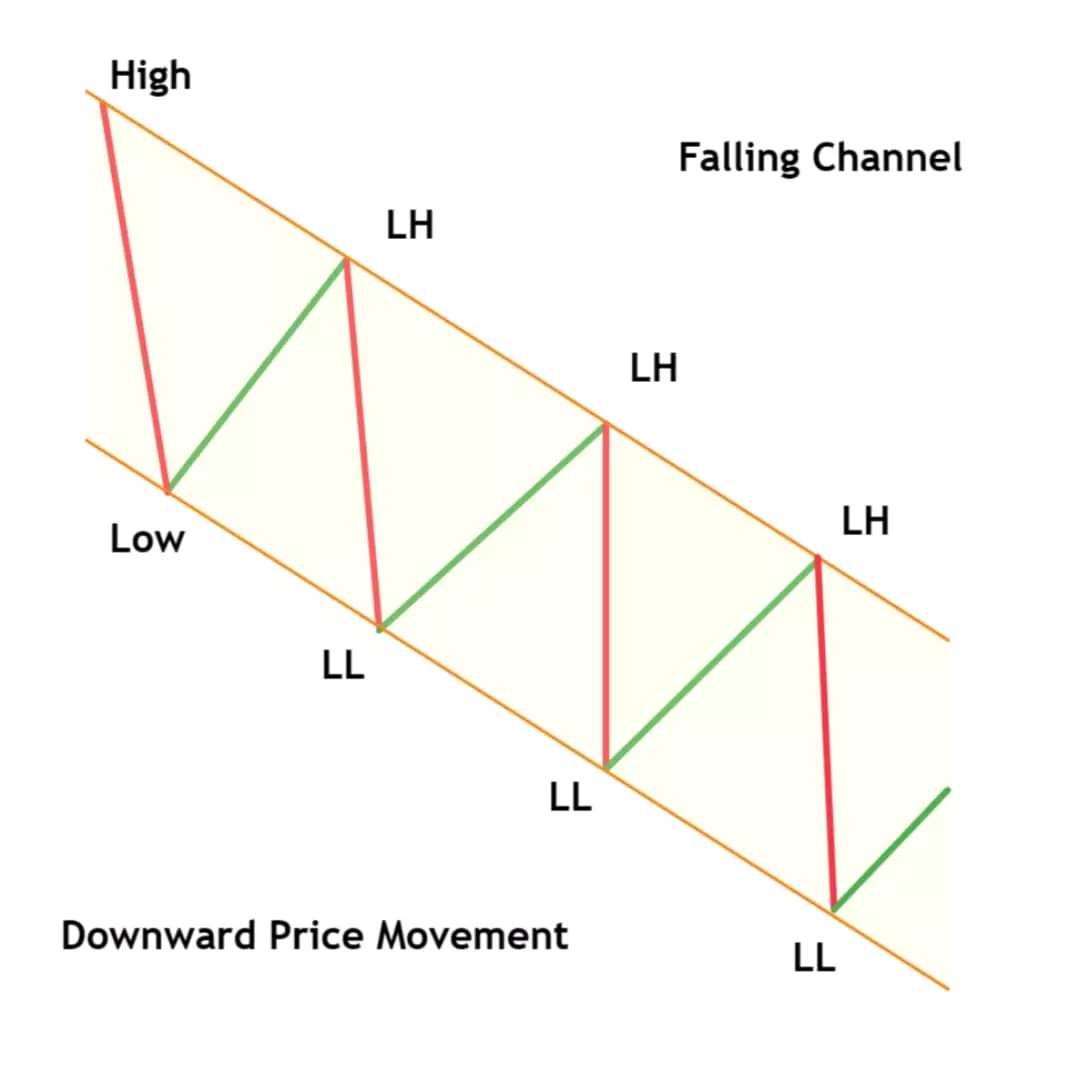

The Falling Channel Chart Pattern is also known as a descending channel pattern. This pattern is used in technical analysis consisting of two parallel downward trendlines. It indicates a price decline and shows the market in a bearish sentiment, marked by lower lows and lower highs.

It is a bearish chart pattern defined by a downward trend line supporting the series of lower lows and lower highs.

When a price is in the channel, prices are expected to bounce off both lower and upper trendline boundaries. Also, if the pattern breaks the lower trendline, we can see more aggressive bearish sentiment, and on the other hand, when the price rises above the higher trendline or breaks the upper trendline, we can expect a bullish reversal sentiment.

How to Identify Falling Channel Pattern

To find the Falling Channel Pattern, follow these steps:

- Identify the Downtrend: Price moving downward with lower lows and lower highs.

- Draw Two Parallel Trendlines: Connect the lows to form the lower trendline and connect the lower highs to form the upper trendline.

- Find the Trend: The channel should be downward in direction, showing a bearish trend.

Formation of Falling Channel Pattern

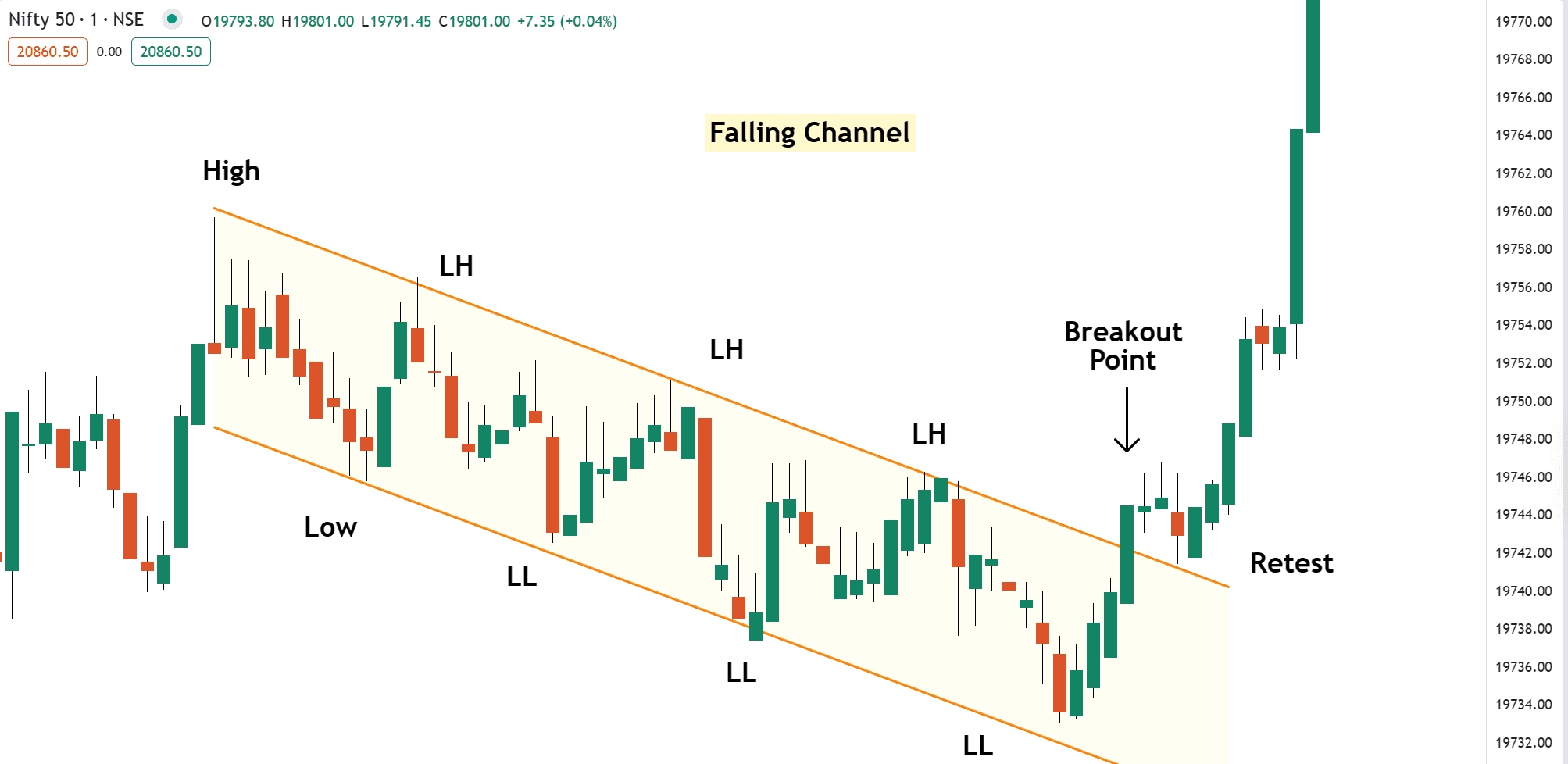

Example 1: Nifty 50 Falling Channel Formation Analysis

Upper Trendline (Act as a Resistance)

Refer to the above example, Connect lower highs (LH) in the downtrend using a trendline. This trendline acts as a resistance level where price touches upper trendline, showing rejections.

Lower Trendline (Act as a Support)

Now Connects lower lows in the downtrend using trendline. This is lower trendline of this channel looks like downward parallel lines and acts as a support level when the price is near to the lower trendline showing buying pressure.

Breakout

When the price breaks below the lower trendline, it signals a strong bearish momentum and when the price breaks above upper trendline support indicates a bullish reversal. (Refer above Example for bullish reversal)

How to Trade the Falling Channel Pattern

Here is a multiple ways to trade in this pattern, Traders enter in various points. like when you find this pattern you can place buying order at support and selling orders at resistance also you find a breakout/breakdown opportunity when price break upword trendline or below support line.

Entery Point

- Bearish Trades: Traders consider selling near the higher trendline of the falling channel and expect the price will fall…

- Bearish Breakout: Traders create a short position when the price breakdown below the lower trendline and retests the previous support…

- Bullish Breakout: Traders consider buying or creating a long position when the price breaks above the upper trendline and retests the previous resistance level…

Stop Loss Strategy

- Bearish Trades: When placing a selling orders in the channel, place stop loss above the previous lower high…

- Bearish Breakout: Traders place stop loss above the recent higher low.

- Bullish Breakout: Traders place stop loss below the recent lower low.

Profit Target

Measure the height of the Falling channel (Distance) and add it upward for bullish breakout or downward for bearish breakout.

Pros & Cons of Falling Channel Pattern

Pros

- Easy to identify

- Provides smooth entry and exit points

- Works well with using multiple timeframes without changing.

Cons

- False breakouts or breakdowns. (for safety, always enter on pull back or retest)

- Requires confirmation for more accuracy.

Common Mistakes to Avoid

Traders place trades without confirming the breakout or breakdown also not waiting for pullback as well as ignoring price action analysis like volume, bigger timeframe trend analysis, etc, during breakout or breakdown. Don’t completely rely on structure always remember chart pattern shows the basic idea, but price action masters your mindset and experience to build your knowledge..