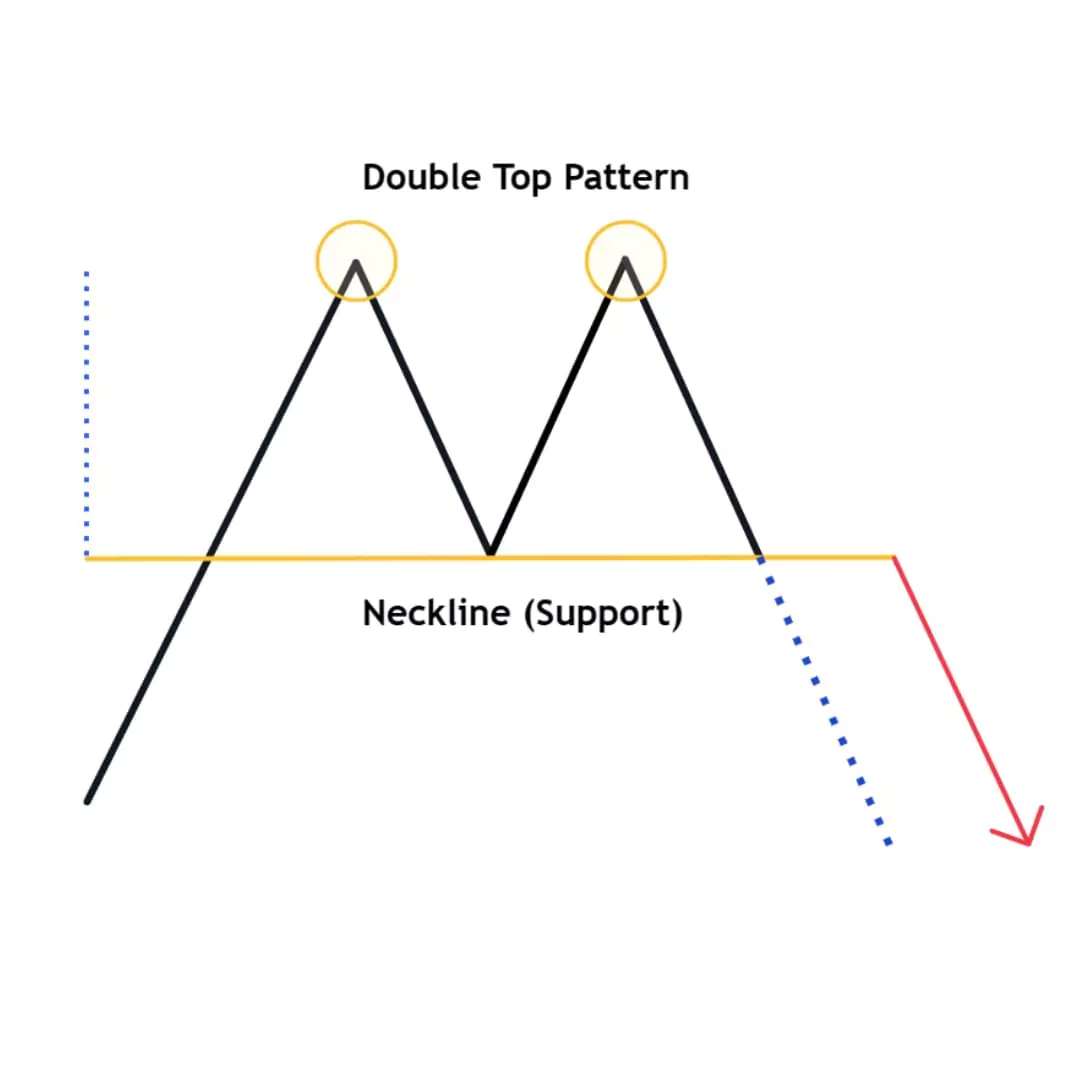

Summary: The Double Top Chart Pattern is a bearish reversal pattern that looks like an ‘M’ shape, formed by two nearly equal highs separated by a dip. It indicates a potential trend reversal from bullish to bearish. Traders look for a breakdown below the neckline/support level and wait for a pullback to enter a short position.

In this blog post, we’ll learn about the double Top (M) chart pattern, how to identify it, trading strategies, examples, and important tips to consider while trading with it. So, let’s discuss…

What is the Double Top Chart Pattern?

The Double Top Chart Pattern is also known as the ‘M’ pattern. This pattern is used in technical analysis to analyse the bearish reversal signal using support and resistance. It forms an uptrend and consists of two nearly equal highs. It indicates a price reversal and shows the market is in a bearish sentiment. (Refer above image)

It is a bearish reversal chart pattern defined by two nearly equal highs in an uptrend followed by a breakdown below the neckline support level.

The pattern is complete once the price breaks below the neckline (support level), indicating a change in market sentiment from bullish to bearish.

How to Identify a Double Top Chart Pattern

To find the Double Top Chart Pattern, follow these steps:

- Identify the Uptrend: Ensure the pattern forms at the top of the market.

- Two Highs: Look for two highs at approximately the same price level, indicating a strong resistance zone

- Neckline: Support level, when the first high was formed and create a new dip so we get a neckline.

- Breakout: The pattern is confirmed when the price breaks below the neckline (support)

Formation of Double Top ‘M’ Pattern

Example 1: Nifty 50 Double Top Formation Analysis

A double top is a bearish reversal chart pattern formed at the top of the uptrend.

This pattern is formed with two highs with neckline support.

First High

First, mark the initial peak where the price stops rising and begins to reverse downward, forming the first top.

Second High

After a moderate decline from the first high, the price rallies again to form a second hight near the same level as the first. This confirms the resistance level. Ensure both highs are at similar levels to validate the pattern correctly.

Neckline (Support)

The support level formed between the two highs is known as the neckline. Confirm that both highs are above this support line. A breakout below the neckline signals a bearish trend reversal.

Breatdown Point

Note, the formation of this pattern is completed when the price breaks the neckline after forming a second high and the pattern is confirmed so traders can enter in bearish positions.

The formation of the pattern is considered complete only when the price breaks below the neckline after forming the second high. This breakdown confirms the pattern, and traders may consider entering short positions.

How to Trade Double Top Pattern

There are certain rules when trading with Double Top ‘M’ chart patterns..

Traders should spot two equal highs and note the size of both.

Traders should only enter in a bearish direction when the price breaks the support level or the neckline level.

Entery Point

Traders enter a short position when the price breaks below the support level.

Stop Loss Strategy

The stop loss should be placed at above the second high of the pattern to manage risk.

Profit Target

The price target should be 1:1, equal to the distance between the neckline and the high.

Pros & Cons of Double Top Chart Pattern

Pros

- Provides perfect entry and exit points

- Effective in various timeframes (Note: The higher the timeframe, the better the pattern works)

Cons

- Requires patience for pattern completion

- False breakouts (for safety, always enter on pull back or retest)

- Not effective in sideways markets.

Common Mistakes to Avoid

Mostly, new traders place trades without confirming the breakout also not waiting for pullback as well as ignoring price action analysis like volume during breakout. Always remember that chart pattern shows the basic idea, but price action masters your mindset and experience to build your knowledge…

- Avoid early entry & early exits

- If data is confusing, don’t place a trade; wait for the next opportunity and protect capital first…

✨ Ready to enhance your trading skills? Join our FREE Trading community……