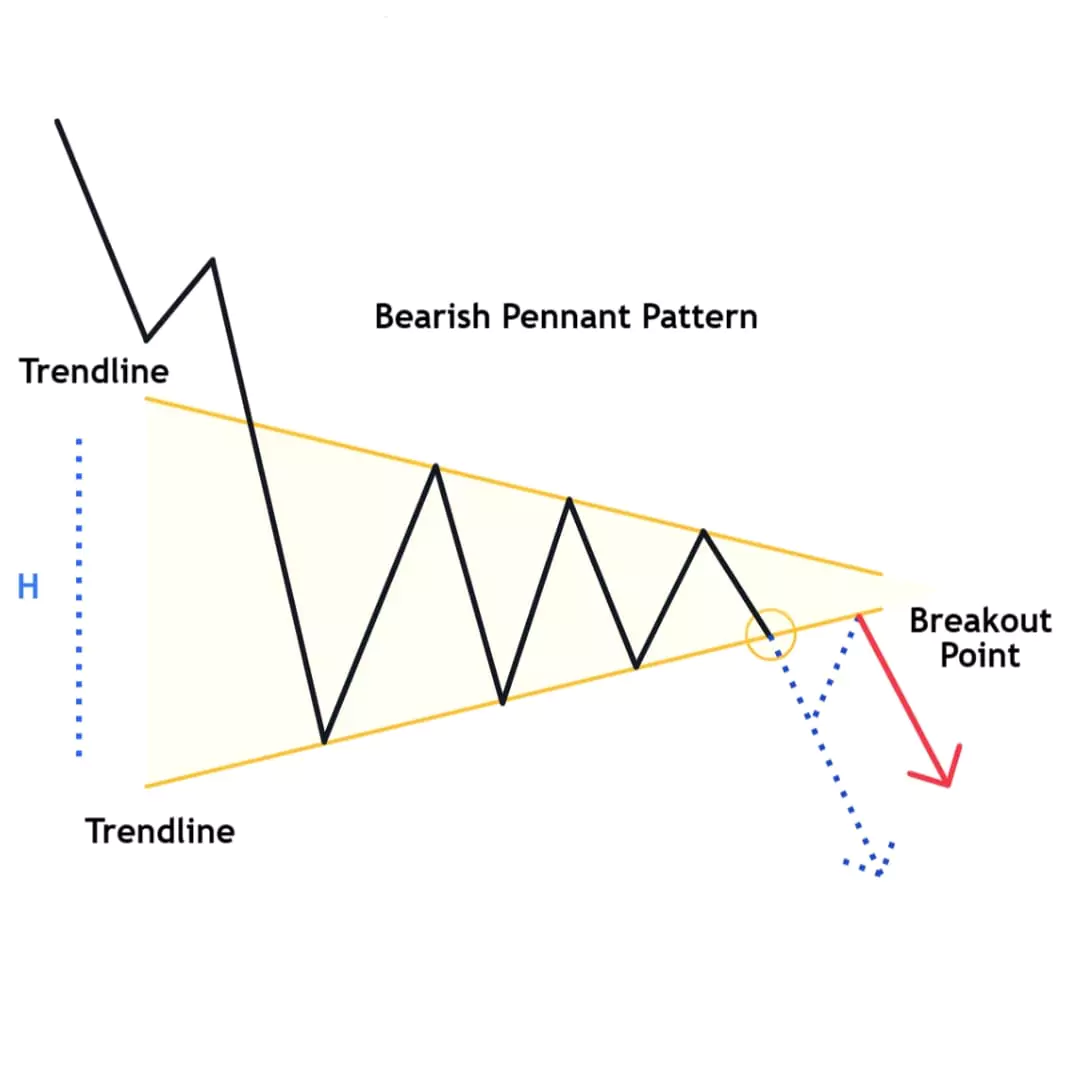

Summary: The Bearish Pennant Chart Pattern is a continuation pattern that forms after a strong downward move, then pauses sideways and forms a small triangle shape. This pattern shows that the price may fall again after a short break. Traders use it to find good selling opportunities with the direction of a trend.

In this blog post, we’ll learn about the bearish pennant chart pattern, how to identify it, trading strategies, examples, and essential tips to consider while trading with it. So, let’s discuss…

What is the Bearish Pennant Chart Pattern?

The Bearish Pennant Pattern is a popular continuation pattern used in technical analysis to identify a downtrend.

This pattern forms after a strong selling pressure, and it takes a pause and moves sideways in small symmetrical triangle, representing a perfect period of consolidation before a breakdown. This pattern also looks like same as the inverted pole and flag, but the difference is that prices are moving in a tight symmetrical triangle.

It’s a popular technical pattern that helps traders spot good entry points during trend continuation.

How to Identify a Bearish Pennant Pattern

To find a Bearish Pennant Pattern, just follow these steps

- Bearish Trend: First, find a strong Downtrend.

- Pennant: A small symmetrical triangle converging with trendlines showing tight consolidation.

- The pattern is only confirmed when the price breaks out below the lower trendline.

Formation of Bearish Pennant Pattern

Bearish Sentiment

Prices moving sharply downward in a short period represent a strong bearish momentum.

This usually happens after a major news event or breakout from another chart pattern showing strong selling interest.

Pennant Formation

After a strong bearish trend price enters a narrow consolidation phase and creates a small symmetrical triangle. Showing a sideways momentum.

Breakout Point

When the pause is over and price breaks below the lower trendline of the pennent, we see a sharp and quick bearish breakout confirming the continuation of the trend.

How to Trade Bearish Pennant Pattern

Here’s the complete guide, how traders can trade this pattern…

Entery Point

Enter the trade when price breaks above the lower trendline of the pennant and wait for a candle close below the trendline confirmation.

Or you can wait for a Retest/Pullback to protect from falls breakdown

Stop Loss

Place the stop loss above the high of the recent swing high.

If the price moves in your direction, trail your stop loss using this technical indicator to protect your gains.

Profit Target

First, measure the high of the sideways consolidation phase, then add that same distance below the point where the breakout happens. This gives you a rough idea of where the price might go next.

Pros & Cons of Pole & Flag Pattern

Pros

- Pattern helps to follow the trend by entering trades in the direction.

- Suitable for short-term trading

Cons

- Requires high patience when market is in tight consolidation (Sideways)

- False breakouts possible (Candle Wicks)

Common Mistakes to Avoid

When trading with this pattern, avoid some common mistakes like trading inside the range and relying too much on textbook patterns.

- Don’t trade inside the pennant. Wait for a clean breakout.

- Misidentifying flags and triangles as pennants.

Most importantly, if the pattern looks confusing, it’s okay to skip the trade to protect your capital is more important.

Have you traded the pennant pattern before? Aside from the pole and flag, what is your favorite chart pattern?

Let me know in the comments below!…..