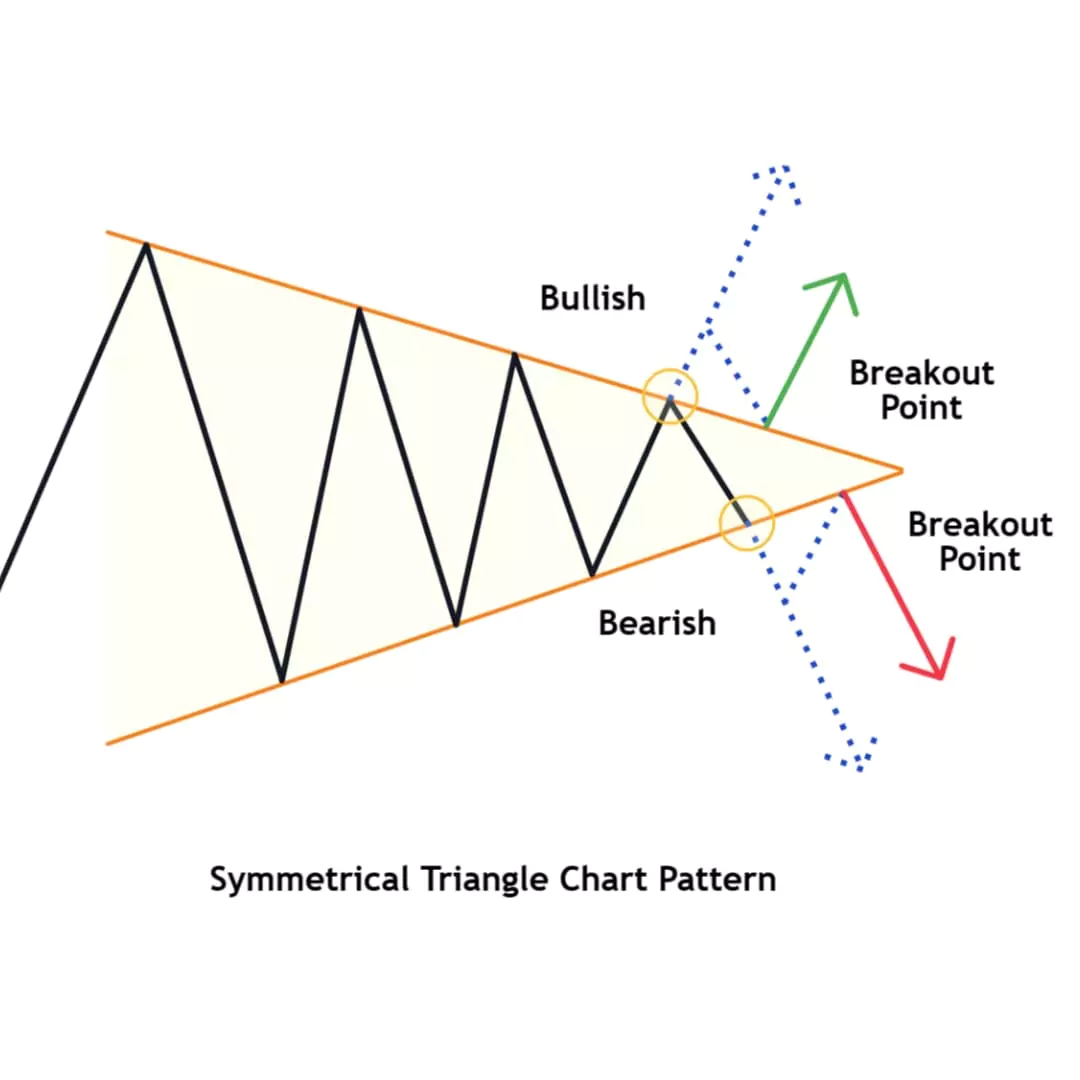

Summary: The Symmetrical Triangle Chart Pattern is a well-known and commonly used chart pattern in trading that can signal both bullish and bearish breakouts. It forms when prices consolidate with converging trendlines, which shows that buyers and sellers are in balance or indecision. A strong move breakout usually happens after this pattern, either upward bullish or downward bearish.

In this blog post, we’ll learn about the symmetrical triangle chart pattern, how to identify it, trading strategies, examples, and essential tips to consider while trading with it. So, let’s discuss…

What is Symmetrical Triangle Chart Pattern?

A Symmetrical Triangle Pattern forms when the price moves between two converging trendlines, which include a downward trendline (Resistance) and an upward tendline (Support). The slope of the lines indicates that neither buyers nor sellers are in control, leading to a breakout in one direction.

Key Characteristics:

- Two converging trendlines

- Indecisive market movementum

The breakout direction determines whether the pattern is bullish or bearish.

How to Identify the Symmetrical Triangle Pattern

It’s simple. Just look for the same as equal triangle and follow these steps:

- Look for Converging Trendlines: Connect at least two lower highs and two higher lows.

- Breakout Direction: When the price breaks above or below the trendlines, it tells us if the market might go up or down next. Both bullish and bearish trends can be seen in this pattern.

Formation of Symmetrical Triangle Pattern

A Symmetrical Triangle Pattern looks like a triangle with both sides sloping towards each other. This is kind of like a slice of pizza 🍕

It happens when the price makes lower highs and higher lows means that buyers and sellers are fighting, and neither side is winning clearly, so the price consolidates in tighter smaller and smaller range.

Example 1: Ninfty Fin Service Bullish Symmetrical Triangle Pattern Formation Analysis

Upper Trendline (Resistance)

Refer above example of the bullish symmetrical triangle pattern

Connecting lower highs shows that the price is forming a downtrend, indicating that buyers are unable to push the price as high as before.

Lower Trendline (Support)

Connecting higher lows indicates that the price is forming an uptrend, showing that sellers are unable to push the price as low as before.

Breakout

When the price breaks above the upper trendline, it tells us if the market might go in the bullish direction.

Example 2: Ninfty Fin Service Bearish Symmetrical Triangle Pattern Formation Analysis

In this bearish symmetrical pattern, the price moves within two tight under-trendlines. showing a pause of indecision before the next move. When the price breaks below the lower trendline support, it shows that sellers are stronger, and the price may continue falling.

Quick Recap: Imagine a spring getting compressed 📏… the more it’s squeezed, the more energy builds up. The Symmetrical Triangle is like that. Once the breakout happens, the move can be quick and powerful.

How to Trade Symmetrical Triangle Chart Pattern

Once you’ve spotted this symmetrical triangle masterpiece, prepare for the perfect trading entry!

Entery

Bullish Breakout: Buy when a candle closes above the upper trendline, which is also known as resistance.

Bearish Breakdown: Sell when a candle closes below the lower trendline, which is also known as resistance.

Stop Loss

For bullish trades, place a stop loss below the most recent swing low.

For bearish trades, place a stop loss above the most recent swing high.

Note: If the price moves in your direction, trail your stop loss using this technical indicator (eg, 20 Moving Average) to protect your gains.

Exit

Measure the height of the triangle (from resistance to the lowest point of support), then add that same distance above the point where the breakout happens. This gives you a rough idea of where the price might go next.

Pros & Cons of Symmetrical Triangle Chart Pattern

Pros

- Can be used in both bullish and bearish markets

- Works well with using multiple timeframes.

Cons

- Requires high patience

- False breakouts may happen.

Common Mistakes to Avoid

- Entering before confirmation: Wait for a strong breakout candle.

- Ignoring trend direction: Symmetrical triangles work well as continuation patterns.

- Not using stop losses: Always add SL to manage risk, especially in volatile markets.

Here’s what I’m curious about…..

Have you traded any triangle patterns before? What is your favorite chart pattern aside from this?

Let me know in the comments below and share your thoughts!…..