Summary: The Rising Channel Chart Pattern is a bullish continuation pattern formed by two upward parallel trend lines acting as support and resistance. It indicates a strong uptrend with higher highs and higher lows. Traders look for breakouts above resistance for bullish signals or breakdowns below support for bearish reversals. Proper risk management and price action analysis are important to avoid false breakouts.

In this blog post, we’ll learn about the rising channel chart pattern, how to identify it, trading strategies, example, and important tips to consider while trading with it. So, let’s discuss…

What is the Rising Channel Chart Pattern?

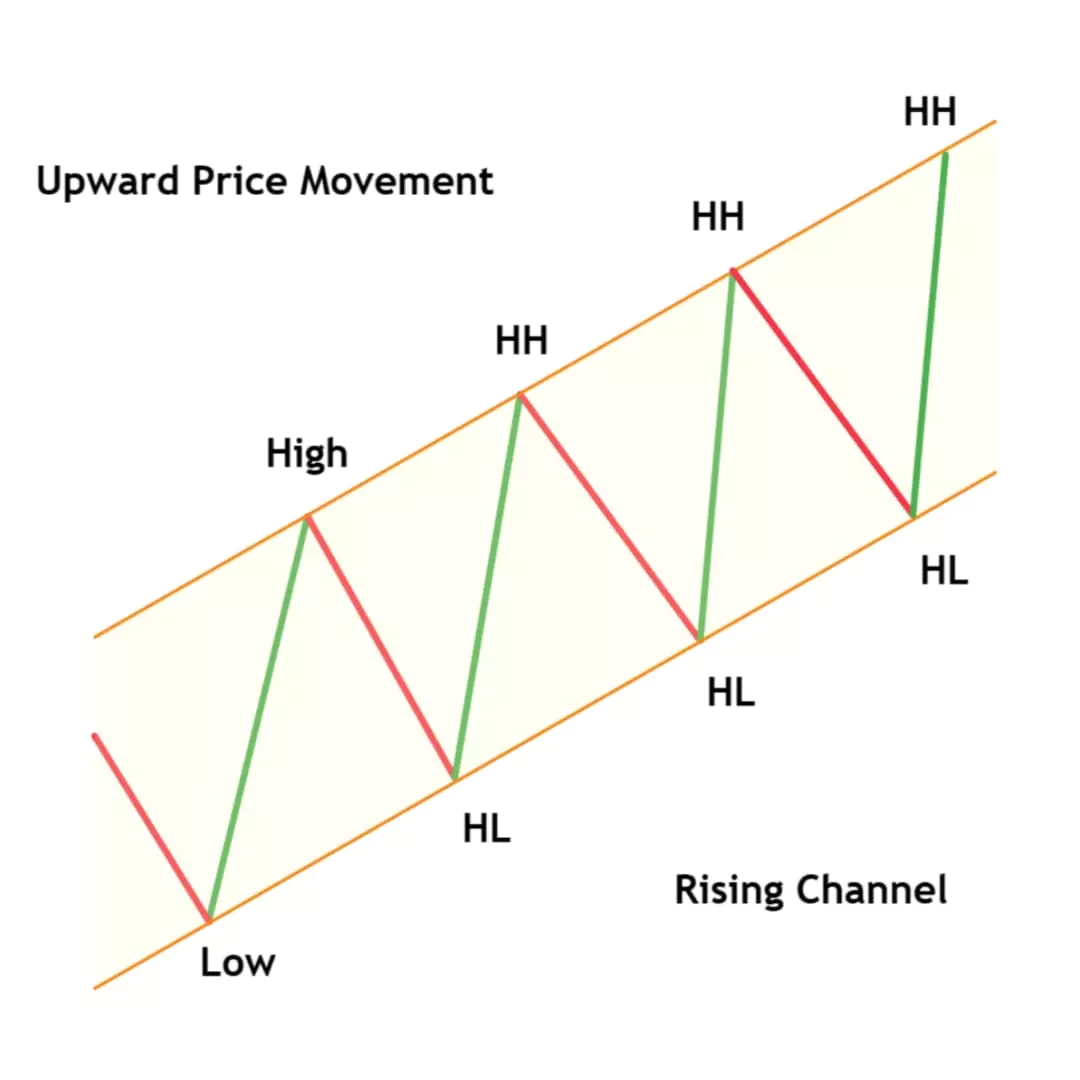

The Rising Channel Chart Pattern is also known as an ascending channel pattern. This pattern is used in technical analysis consisting of two parallel upward trendlines. It indicates a price increase and shows the market in bullish sentiment, marked by higher highs and higher lows.

It is a bullish chart pattern defined by an upward trend line supporting the series of higher lows and higher highs.

When a price is in the channel, prices are expected to bounce off both upper and lower trendline boundaries. Also, if the pattern breaks the upper trendline, we can see more aggressive bullish sentiment, and another side when the price falls below the lower trendline, we can expect a bearish reversal sentiment.

How to Identify Rising Channel Pattern

To find the Rising Channel Pattern, follow these steps:

- Identify the Uptrend: Price moving upward with higher highs and higher lows.

- Draw Two Parallel Upward Trendlines: Connect the highs to form the upper trendline resistance line and connect the lows to form the lower trendline support.

- Find the Trend: The channel should be upward direction showing a bullish trend.

Formation of Rising Channel Pattern

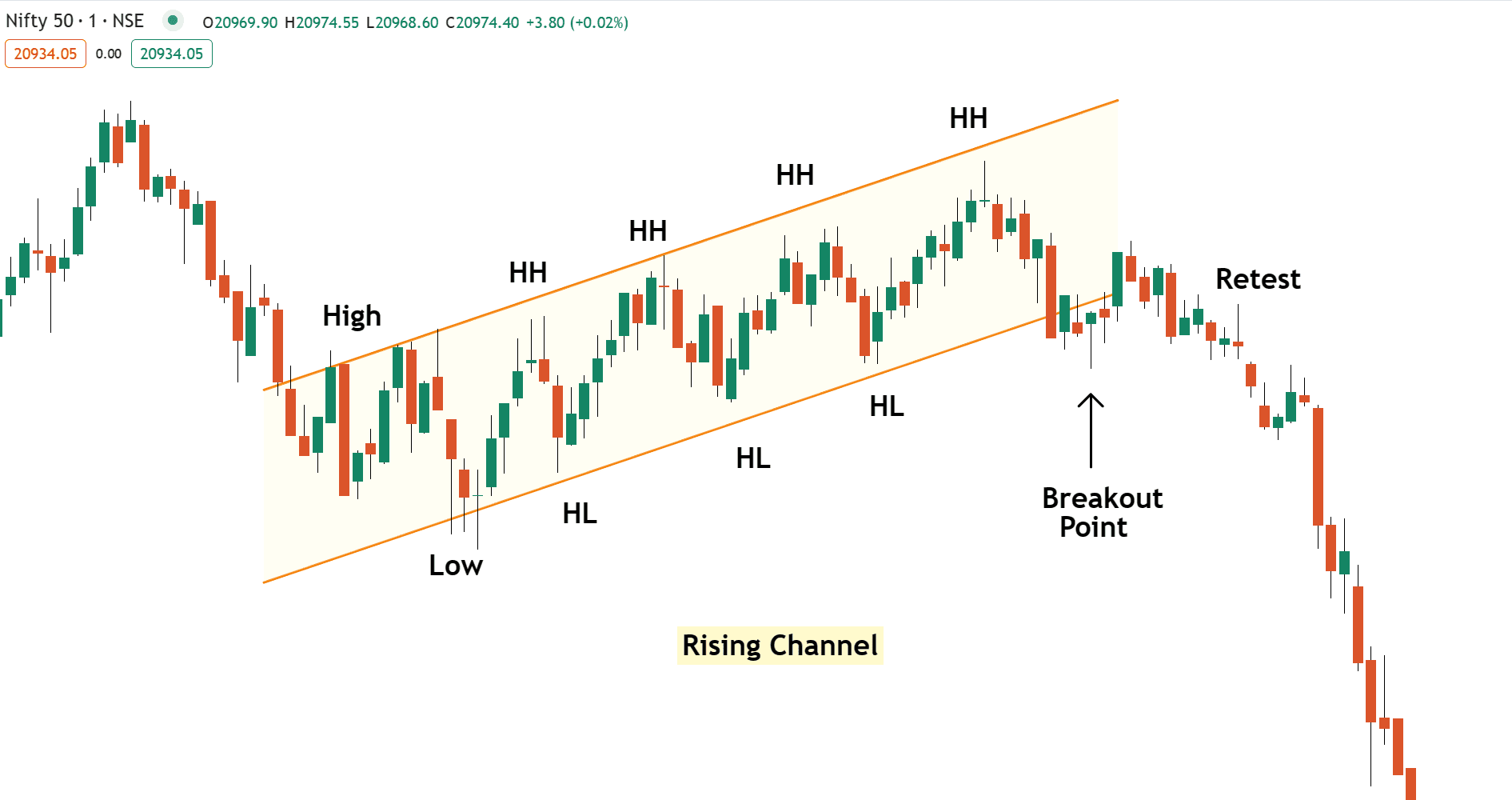

Example 1: Nifty 50 Rising Channel Formation Analysis

Upper Trendline (Act as a Resistance)

Refer to the above example, Connect higher highs in the uptrend using a trendline. This trendline acts as a resistance level where price touches upper trendline, showing rejections.

Lower Trendline (Act as a Support)

Now Connects higher lows in the uptrend using trendline. This is lower trendline of this channel looks like parellel lines and acts as a support level when the price is near to the lower trendline showing buying pressure.

Breakout

When the price breaks above the upper trendline, signals a strong bullish momentum and when the price breaks below the lower trendline support indicates a bearish reversal. (Refer above Example)

How to Trade the Rising Channel Pattern

Here is a multiple ways to trade in this pattern, Traders enter in various points. like when you find this pattern you can place buying order at support and selling orders at resistance also you find a breakout opportunity when price break upword trendline or below support line.

Entery Point

- Bullish Trades: Traders consider buying near the lower trendline of the rising channel and expect the price will bounce…

- Bullish Breakout: Traders consider buying when the price breaks above the upper trendline and retests the resistance…

- Bearish Breakout: Traders enter a selling position when the price breaks below the lower trendline and retest the support level…

Stop Loss Strategy

- Bullish Trades: When enter a buying trade in the channel, place stop loss below the previous higher low…

- Bullish Breakout: Traders place stop loss below the recent higher low (Trendline Support).

- Bearish Breakout: Traders place stop loss above the recent higher high (Trendline Resistance).

Profit Target

Measure the height of the rising channel (Distance) and add it to upward for bullish breakout or downward for bearish breakout.

Pros & Cons of Rising Channel Pattern

Pros

- Easy to identify

- Provides clear entry and exit points

- Works well with using multiple timeframes without changing.

Cons

- False breakouts or breakdown (for safety, always enter on pull back or retest)

- Requires confirmation for more accuracy (learn Price Action)

Common Mistakes to Avoid

Traders place trades without confirming the breakout or brakdown also not waiting for pullback as well as ignoring price action analysis like volume, etc during breakout or breakdown. Don’t completely rely on structure always remember chart pattern shows the basic idea, but price action masters your mindset and experience to build your knowledge…